From FFI Practitioner

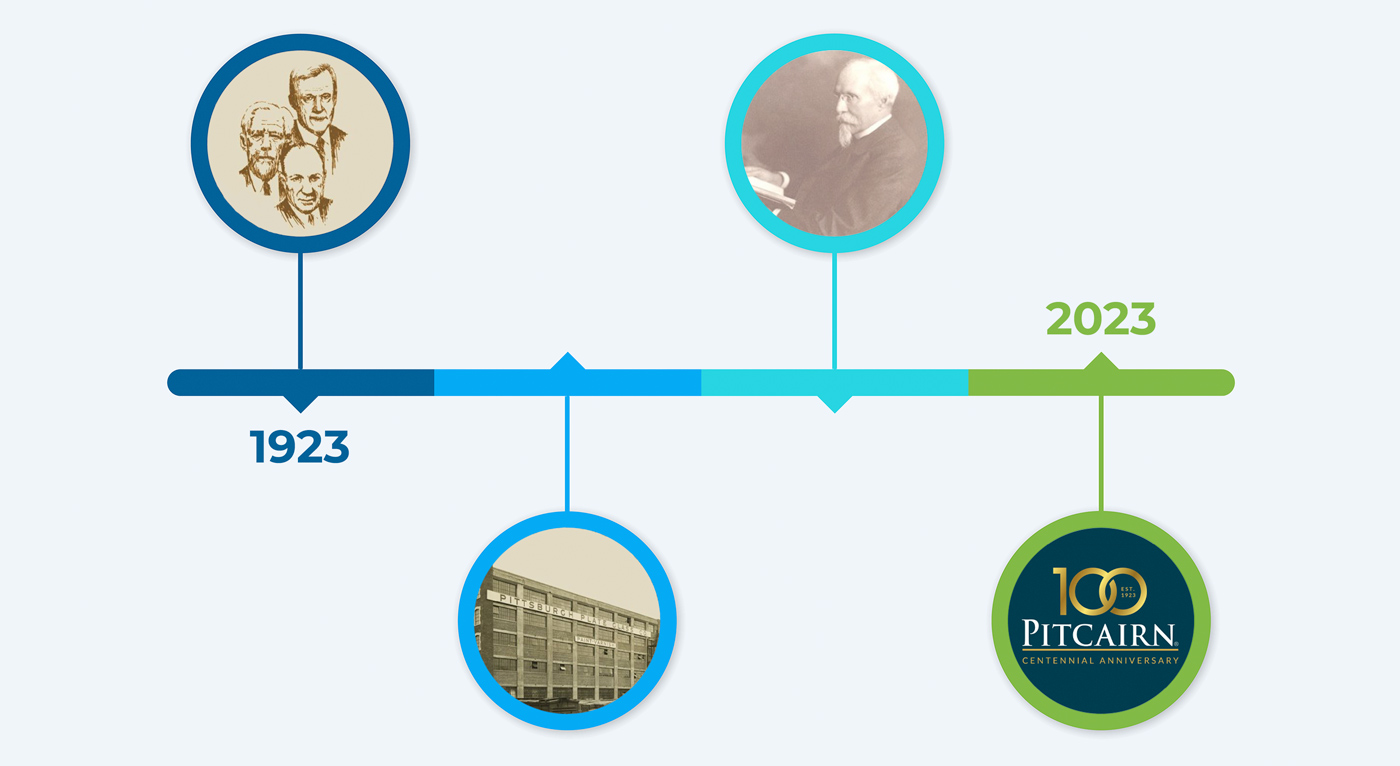

Dirk Junge (DJ): I am pleased to have the opportunity to discuss two of my favorite subjects: the evolution of the family office and the evolution of the Pitcairn family office over the last 100 years. When we set the stage for this evolution, it’s important to realize that Generation One for the Pitcairn family clan started with my great-grandfather John Pitcairn, Jr., a Scottish immigrant who came to this country in the 1850s. He was a serial entrepreneur, and after a career in the Pennsylvania Railroad, he made his first fortune by developing oil and gas companies as an operator.

He took advantage of the 1870s being a prolonged economically depressed time, took his capital from oil and gas, and co-founded the Pittsburgh Plate Glass Company in 1883. In ten years after being a start-up, PPG (Pittsburgh Plate Glass in that era) represented seventy percent of all the glass made in America.

As I mentioned, he was a serial entrepreneur and, as we found over the years, entrepreneurship is one of the only antidotes to families going through “shirtsleeves to shirtsleeves.” The Pitcairn family has always honored entrepreneurial spirit. I guess we could say that success breeds success.

FP: And then, from the early 1900s to 1950?

DJ: In the first fifty years we see my great-grandfather, John Pitcairn, Jr., develop a Fortune 500 company. When he died in 1916, my grandfather, his eldest son, then convinced his two younger brothers to form the Pitcairn Company. They took the stock coming from their father’s estate and put it into a pooled vehicle called a personal holding company. Each one of those gentlemen had nine children. They were still the majority owner of the PPG stock. Forming The Pitcairn Company, the family holding company, in 1923 was one of those key elements to the success of the Pitcairn family.

Having a corporate enterprise focusing on the assets of the family over the generations allowed there to be fairness. Without fairness, a family can eat at the trust, which is necessary for generational transition. The Pitcairn family office ultimately put together a staff of professional accountants, lawyers, tax specialists, trust and estate specialists, and did an outstanding job of having the Pitcairn family move its assets into long-term, multigenerational trusts. Trusts have been a key to the sustainability of the family over the generations. At the outset, the family trust had the three sons of John Pitcairn as the trustees.

Sidebar

by Karen Carlson

In this edition, Karen Carlson, Pitcairn’s Managing Director, examines the benefits to engaging the next generation in family enterprise philanthropy activities at a young age and provides several best practices for next generation philanthropic engagement.

DJ: Now we get to the 1950s. PPG, which was still the largest egg in our basket, was going through a downturn, and was considered a conglomerate “pig” by Wall Street—not good. My father was a chemical engineer, and he had developed a very successful consulting practice. My grandfather had to recruit him to come in and take the lead director position at PPG and be the principal CEO of the holding company.

Dad’s approach was that PPG needed a new strategic plan. He put together a ten-year plan called the “Blueprint for the Future.” It required a complete change of the board of PPG, new management, a recommitment to R&D and physical plant and equipment. About five years into the ten-year plan, Wall Street considered PPG a growth investment opportunity, a complete paradigm shift. This allowed my father to diversify the assets of the holding company, where we could sell a block to the market and bring those proceeds back and put them into a highly diversified personal holding company. That required my father to build an institutional quality investment management team at Pitcairn. With a fabulous track record, Pitcairn was now seen as a quality family office and was sought out by many families coming to see the successes of the Pitcairn family.

FP: When did you enter the family business?

DJ: I came to the company shortly after my older cousin departed in 1983. I was the only family member who was a trained, educated, and experienced trust and investment person. My uncles, at that point representing the three branches, had heard about the Wharton Family Forum. The Wharton Family Forum ended up being very important to Pitcairn’s transition over the years. We learned things like the importance of independent directors, a family constitution, a family mission, and family values to be written down.

As we moved through that experience, we come to 1986, which was a very important time for our family. Successful families over the generations need liquidity programs. With the change in the 1985/1986 tax law, it no longer was advantageous to hold corporate assets. We needed to change to a partnership. This was done through a Section 337 liquidation. That liquidation required, with tax counsel, that we sell ninety percent of the assets of this highly diversified holding company, which meant that we needed to sell our control block of PPG. This was a shock to the family. However, it addressed our ability now to start—and our world-class MFO in 1987 as Pitcairn Trust Company.

As you can see, every time a family goes through a generational transition, or changes its business focus, that’s risky business.

FP: So now on to the podcast with Dirk Jungé and Leslie Voth to hear more about how Pitcairn navigated 1986-2023!

Listen to their conversation

About the Contributors