Background

Asia is in the midst of one of the largest waves of wealth transfer, yet generational transition remains unchartered territory for many business families here.

Wealth creation in most parts of Asia began post World War II, or after a country’s independence. For most business families, wealth is still largely generated and controlled by the first and second generation of entrepreneurs, and wealth transfer only started taking shape in the last decade or so. Families are also often reluctant to kickstart conversations about transition, as death is considered a taboo subject in many Asian cultures, delaying such discussions until it is too late.

Lastly, the provision of relevant advice and services to help families is often fragmented, with each provider covering their own area of expertise, leaving families with little prior experience to piece together different parts of the transition puzzle.

For these reasons, generational transition often ends up poorly planned and executed.

The Approach

All roads lead to Rome. “Rome,” in the context of generational transition of wealth, is a well thought-out roadmap to passing control and ownership to the next generation while achieving the goals agreed upon by all involved family members and related parties.

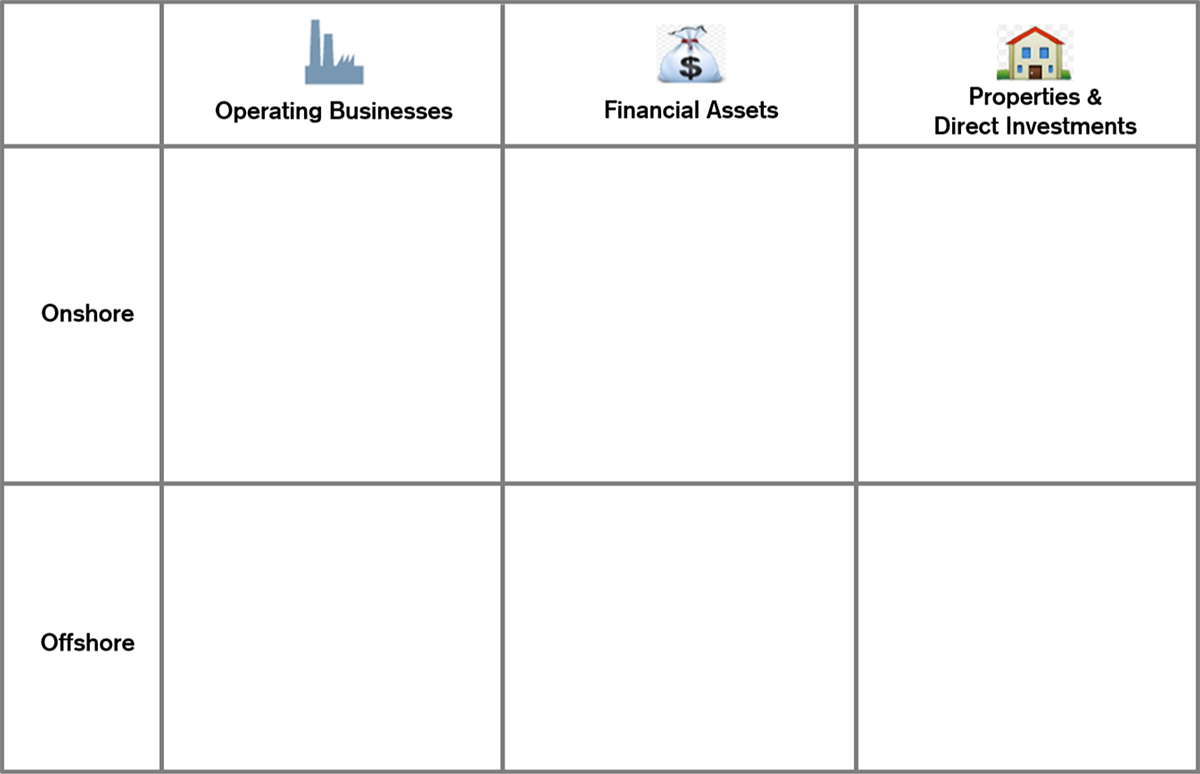

First, the journey must begin. One effective approach in starting a conversation with a business family is to use the Six Buckets Exercise.

- Onshore Operating Businesses

- Onshore Financial Assets

- Onshore Properties and Direct Investments

- Offshore Operating Businesses

- Offshore Financial Assets

- Offshore Properties and Direct Investments

Each family is different, as is usually the source of its wealth, and increasingly there are multiple countries and jurisdictions to take into account during the wealth planning process. For tax and legal considerations and other reasons, advisors should split the three “buckets” further into onshore (e.g. assets or place of effective management located in their home country or in a location considered core to the family) and offshore components.

How does a Six Buckets discussion work?

As most practitioners are aware, when discussing wealth transitions with family clients, it is often important to keep things simple.

Transition simply means that the family—not just the decision maker(s)—understands where they are today with regards to family, wealth, ownership, and control, and where they would like to be in the future. The applicable time frame is defined by the family—usually, no fewer than two generations.

Once the family establishes and agrees with where they are currently and where they would like to be in the future, a discussion will have to happen on how to get there.

There might be many roads to Rome, but each path has its pros and cons. The role of advisors is to help families make a well-considered decision and help them to recognize the potential pitfalls of the path they decide to take.

Family members involved in the Six Buckets exercise write down their thoughts on their individual worksheets (as seen in Figure 1).

Current State of each Bucket

- Assets

Can you list on the worksheet the assets of the family? - Ownership

Is the legal ownership of these assets clear and reflective of the actual ownership?

- Control

Who manages these assets?

Future State of each Bucket

On a second Six Bucket worksheet, each family member repeats the exercise for the plans for the future of each asset.

- Assets

Can you describe a strategic plan for the future of each asset listed in the “Current State” worksheet? - Ownership

Is the succession plan for each of the listed assets clear?

- Control

Does the succession plan assign managers for these assets?

It will be quite rare that individual family members are able to provide complete and consistent responses among themselves. By using and sharing the outcomes of the Six Buckets exercise at a family meeting, it helps families to identify and agree on areas of concerns, and to differentiate between a symptom and a cause.

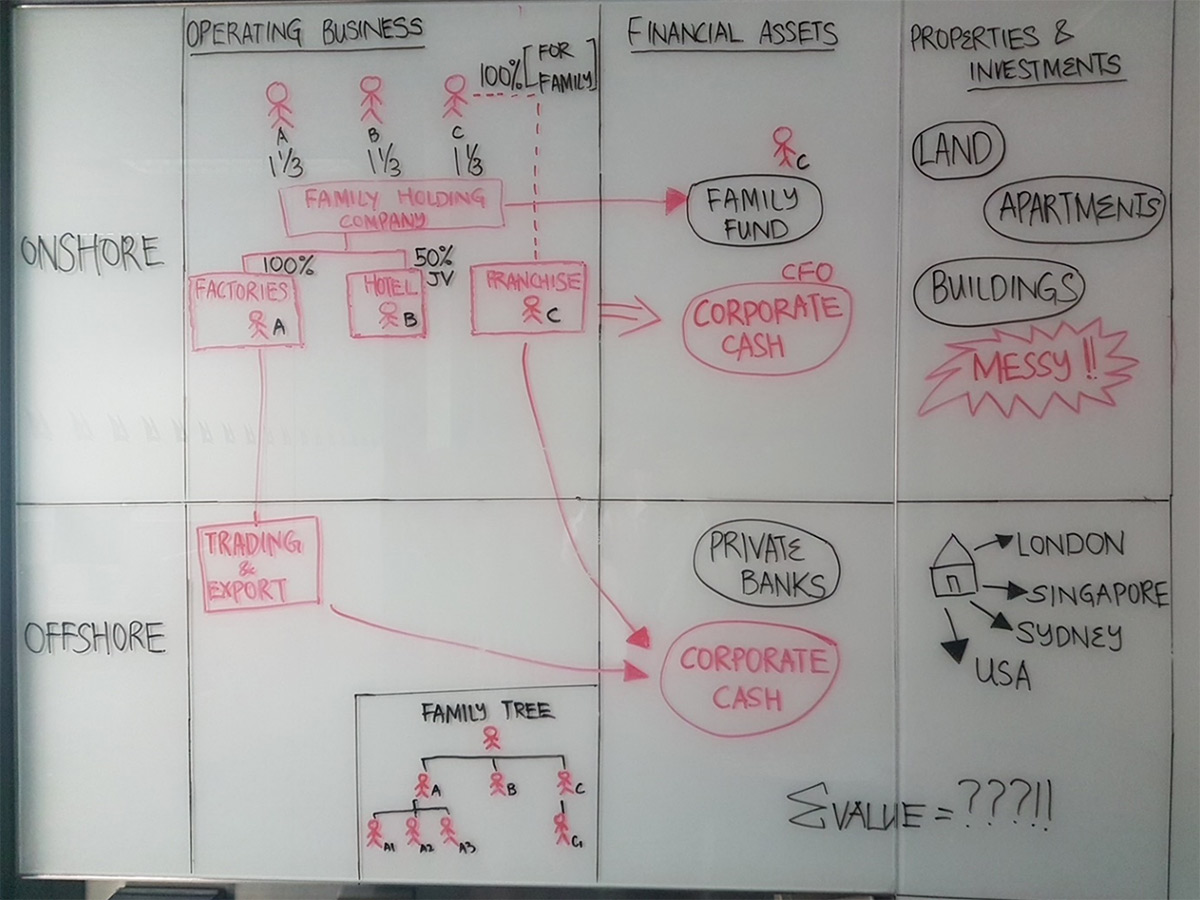

An example to illustrate the Six Buckets framework

A business family from Southeast Asia in its second generation, comprised of three siblings (A, B, C), struggled to agree on the future direction of the business and the roles they and the next generation (A had three children and C had one child) will play.

- Bucket One: Onshore Operating Businesses

The family business includes manufacturing, a hotel, and a local franchise business, all in the family’s home country. The first two business are held via a privately-held family holding company (100% for the manufacturing, 50% joint venture with an international chain for the hotel), which is owned equally by the three siblings. The franchise business is held 100% by sibling C, on behalf of the family, as the franchiser will only enter into the agreement with C, who secured the deal.

- In terms of management, each sibling is in charge of one business unit: A oversees the manufacturing business, B runs the hotel, and C runs the franchise business. The actual management of the hotel is provided by the joint venture partner, with B serving as the figurehead.

- The operating businesses are the largest and most important part of the family’s material wealth.

- Bucket Two: Onshore Financial Assets

Any distributed dividends flow into a family fund owned equally by the three siblings, with C in charge of its management. The corporate cash is managed by the Group CEO, who is a non-family member.

- Bucket Three: Onshore Properties and Direct Investments

The family owns large tracts of lands, as well as commercial and residential properties, some of which are currently used by the siblings as their primary residence and also by the business for the various operations. The family is not able to clearly identify actual ownership for many of these assets.

- Bucket Four: Offshore Operating Businesses

Five years ago, the family business set up a trading and export business overseas, resulting in healthy cash flow.

- Bucket Five: Offshore Financial Assets

The cash flow from the franchise and the overseas trading and export business help build a sizeable pool of corporate and family cash. It is expected to grow significantly in years to come.

- Bucket Six: Offshore Properties and Direct Investments

The family has acquired residential apartments in various countries for the purpose of having a vacation home or accommodation for next-generation family members pursuing overseas studies. The apartments are held in the company’s name.

Figure 2 illustrates what a discussion of the Current State worksheet from this family might look like.

What does the outcome of the Six Buckets exercise, as exemplified in Figure 2, tell the family?

Based on the results of the discuttion, the family identified the following areas to prioritize:

- Ownership of the franchise (currently entirely held by C) has to be equalized among the other siblings.

- The family’s financial pool (onshore and offshore) has grown, and there is a need for further discussion on the purpose and management of this financial wealth.

- There has been no serious discussion on professionalizing the business, and having all three siblings take the helm of running each individual business unit is not sustainable over time. Without agreement on the roles of the three siblings, it will then be difficult for the next generation to join the family business, should they wish to do so.

- It is time to sort the ownership of the properties and direct investments into what belongs to the business, to the family, and to individual siblings.

The family agrees to start with the most important topic: ownership. The road to transition thus begins.

Conclusion and Summary

The Six Buckets can be a useful exercise to help families identify information gaps, common areas of concerns to work on, and the relationship between different areas of concerns.

For example, in the above case study, the siblings are unlikely to think seriously about retirement if there is no mechanism in place to ensure that there is an acceptable distribution of dividends to them directly. Moreover, it is unclear whether the siblings and their families can have access to part of the financial assets pool built up over the years.

Looking to the future, the Six Buckets reminds business families that the nature and components of a family’s wealth change over time. Business don’t stay the same – they evolve and are disrupted. Likewise, investments and markets have their own cycles. A roadmap is therefore critical to achieve a family’s long-term goal.

For this family, the siblings recognized that the manufacturing business, which was founded by the late father, may not deliver sustainable returns in the long run, in view of strong competition from multinational corporations. Therefore, instead of pouring cash into the business, they decided that they may be better off deploying the financial assets for other uses.

Lastly, while the Six Buckets discussion starts off as a family or clan exercise, it builds a strong foundation to help individual family members or branches think about their own Six Buckets.