From FFI Practitioner

Panta rhei. Everything flows and evolves. And family businesses are no exception. From the first-generation founder firm to a real family firm in later generations, and from a single business firm to a complex portfolio business. In some instances, that transition in the family firm – from one to many businesses – happens rather suddenly, in a revolutionary way. Such transformations usually require a few key elements: a natural entrepreneur in the later generations of the family and… a major liquidity event that financially enables the transformation. Marta Widz and Benoît Leleux from IMD illustrate the strategic transformation from single to multiple business family portfolios by analyzing two cases where the transformations shared stunning similarities.

In this edition of FFI Practitioner, we present two remarkable stories of multigenerational families behind very large, global, successful portfolios of businesses.

Pentland: From shoes to a “family of brands”

Owned by just six family members from second and third generations, it employs more than 20,500 people worldwide and generates about £2.9 billion in sales.

Pentland Group’s roots can be traced back to 1932, when Berko and Minnie Rubin – immigrants from Eastern Europe – set up the Liverpool Shoe Company, a small fashion footwear business, with just over £100 as a capital base raised from family and friends.

In 1969 Stephen, the only child of the firm founders, took over the business when his father passed away. He immediately started with diversification investments in consumer products, electrical goods, and even construction. He also pioneered the outsourcing of footwear manufacturing to Asia in the early 1970s.

Stephen’s natural flair for entrepreneurship also allowed him to strike some spectacular deals. In 1981, Pentland invested US$77,500 for a majority stake in a struggling American sports brand called Reebok. This investment was sold 10 years later for $770 million, a 10,000+ multiple and the stuff of legends.

With the sale of the Reebok stake, Pentland was flush with cash and used it to finance a series of acquisitions to build a family of prestige sporting goods labels. For Andy, the son of Stephen, 1991 was very special: “It was a watershed year because that was when we sold the Reebok stake. That was also the year I joined the business fresh from business school. We were sitting on a big pile of cash and we talked about what we wanted to do with it. We set our strategy on building a portfolio of brands that we could own or license.”

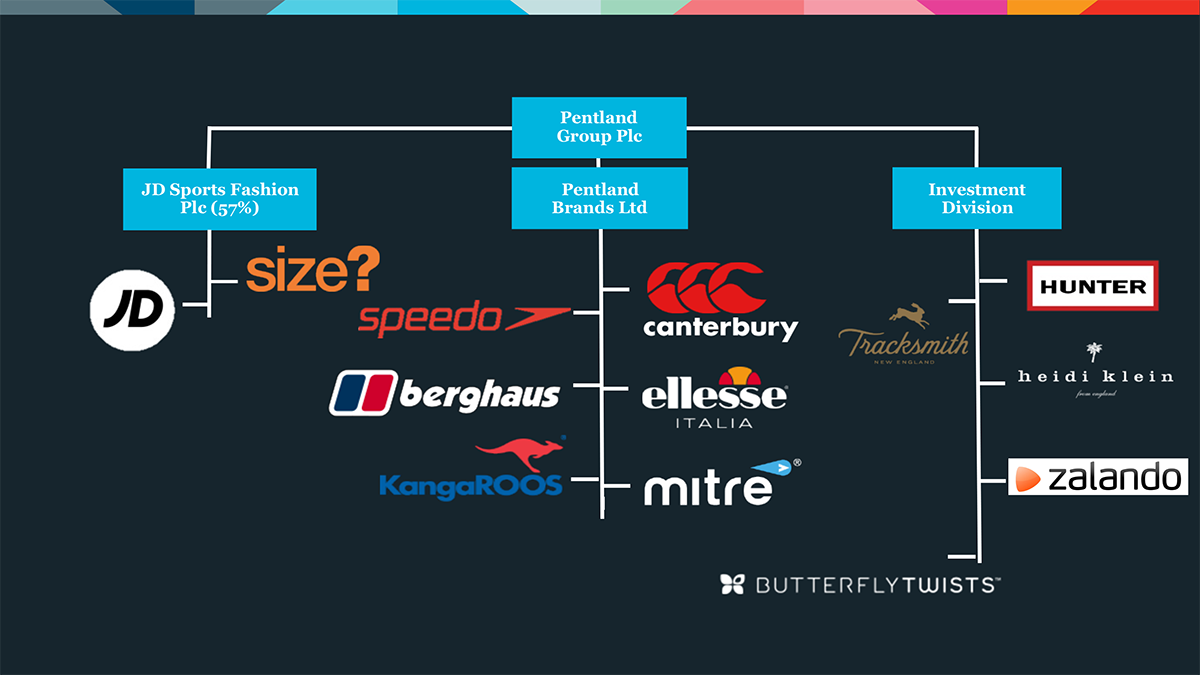

Currently Pentland Group plc operates in the areas of sports, fashion, outdoor clothing and equipment through three divisions.

- Its legacy business, Pentland Brands, manages a portfolio of owned brands including Speedo, Berghaus, Canterbury, Mitre and KangaROOS; Lacoste and Karen Millen as licensed brands for global footwear, and Kickers as a licensed brand for the UK.

- The retail division comprises JD Sports Fashion, a chain of over 1,300 retail shops, in which Pentland Group is a majority ownership stake of 57%. It is the most significant stake in Pentland’s portfolio and the one, which shows the fastest growth.

- The Investment Division supports group diversification by investing in new ventures or partnering with start-ups with a mandate to learn from entrepreneurs and innovate.

“The conditions under which a family makes a transition from “family-in-business” to “family-in-portfolio of businesses” include, among others, a natural entrepreneur from among the family members who can embrace business opportunities.”

Brands in Pentland’s portfolio: selection

Andy Rubin, third generation family member, the Chairman of Pentland Brands and its ex-CEO, comments on the development of the Pentland portfolio:

“My father has always been a very natural entrepreneur. He enjoys making deals with people that he meets around the world. Through that, the group diversified into all sorts of products and categories, outside of the core business of shoes, and then sports, and then brands.”

The development of Pentland’s portfolio is a dynamic story of diversification and re-focusing, string of acquisitions, and partnerships with entrepreneurs via venturing with family capital. Guided by a single purpose: “Building a family of brands for the world to love, generation after generation” Pentland developed a portfolio of owned fashion and sports brands and later on moved into retail, which is now the biggest part of its portfolio marginalizing the legacy business at the fast paste.

De Agostini: From cartography to portfolio businesses

De Agostini group is headquartered in Novara and Milan, Italy, employs over 13,000 people worldwide and, in 2017, generated a turnover of about €4.8 billion.

Established in 1901 by cartographer Giovanni De Agostini, the company was acquired almost 20 years later by partners Marco Adolfo Boroli and Cesare Angelo Rossi. In 1946, Marco Adolfo Boroli’s two sons, Achille and Adolfo Boroli, consolidated De Agostini in the Boroli family’s hands.

For over 80 years, De Agostini operated in its original cartography, publishing, graphics and printing industries. In the late 1980s, third generation chairman and family leader Marco Drago took the company on a global expansion, which began with the international expansion of the legacy publishing business, first to the UK and then to over 30 countries across the globe.

Sidebar

IMD invites you to nominate a family business whose commitment to best practices in both family and business makes it outstanding.

Every year since 1996, a global leading family business has been honored with the IMD Global Family Business Award, sponsored by Pictet.

In 2017 and 2018 respectively, Pentland Group and De Agostini won the IMD Global Family Business Award, sponsored by Pictet.

Help us celebrate the important role family businesses play in the global economy; nominate an outstanding Global Family Business for the 2019 Award. Send your online nomination by 31 March 2019.

An important milestone for De Agostini came in 1997 with its participation in the privatization of Seat Pagine Gialle (Yellow Pages). After a successful turnaround, it was sold to Telecom Italia in 2000 for a more than 7 times multiple. This liquidity event marked the beginning of the group’s rapid expansion, with De Agostini taking advantage of the windfall to venture into exciting new territories.

“The money we earned on the Yellow Pages were invested wisely: half of it was devoted to diversify the portfolio”, said Lorenzo Pellicioli, non-family CEO of De Agostini.

Roberto Drago, third generation family shareholder, vice-chairman of De Agostini, board member of B&D Holding and a younger brother of Marco Drago, explained: “The liquidity after selling the stake in Yellow Pages enabled us first, to invest in Lottomatica in the gaming industry in 2001, and second, to gain experience in the financial industry. In 2003 we bought Toro Assicurazioni, the insurance company, and then sold it to Generali in 2006, which in turn allowed us to start our own financial activities – DeA Capital.”

Within just two decades the single-family business was transformed by Marco Drago to an investment family overlooking an international powerhouse with four major business sectors:

- The legacy Publishing business, De Agostini Editore, fully owned by the Drago-Boroli family, which makes up only 3% of the total portfolio in terms of Asset Value in 2017 (including publishing activities of Grupo Planeta-De Agostini) and 8% in terms of net revenues.

- Media & Communication, with activities in broadcasting, content production and distribution for television, new media and cinema, through Atresmedia (listed on the Madrid Stock Exchange) and Banijay Group Holding. In 2018 De Agostini held a 20.9% stake in Atresmedia through a joint-venture with Spanish Planeta Corporation and a 34.2% stake in Banijay Group Holding. Media & Communication made up 15% of the total De Agostini’s portfolio Asset Value in 2017.

- Gaming & Services: De Agostini held a 50.6% stake in IGT (for International Game Technology) – the largest global player in the gaming and services sector, which was headquartered in London, UK and listed on the New York Stock Exchange (NYSE). De Agostini was the majority shareholder in IGT, which accounted for 64% of its total portfolio Asset Value in 2017.

- Financial Services: DeA Capital, which listed on the Milan Stock Exchange has activities in private equity, alternative investments (DeA Capital Alternative Funds) and real estate (DeA Capital Real Estate). Financial services (including DeA Capital and the stake in Assicurazioni Generali) made up 15% of De Agostini’s portfolio Asset Value in 2017, with almost half of that accounted for by the stake in Assicurazioni Generali (about 8%).

“The money we earned on the Yellow Pages were invested wisely: half of it was devoted to diversify

the portfolio”

– Lorenzo Pellicioli, non-family CEO of De Agostini

Business Entities in De Agostini’s portfolio: selection

“Marco Drago is in fact the founder of De Agostini Group in its current shape”, commented Lorenzo Pellicioli.

Currently the business portfolio belongs to more than 60 family shareholders, all direct descendants of Marco Adolfo Boroli, bearing mostly the last names Boroli and Drago. Their control of the De Agostini Group is organized through B&D Holding, their private family holding company.

The development of De Agostini’s portfolio is a dynamic story of mergers, acquisitions, partnerships, rebranding and divestments. Between 1997 and 2017, De Agostini transformed itself from a traditional business active predominantly in publishing and printing into an investment holding company, through cumulative investments of €16,4 billion and divestments of €8,0 billion. A radical transformation of the family business in just 20 years!

The Family Portfolio Dynamics

Advisers need to understand the dynamics of the family firms. And the reality of such an evolution is complex: from a founder firm to a family firm, and under some conditions, from a family business to a business family with many business entities in the portfolio.

The conditions under which a family makes a transition from “family-in-business” to “family-in-portfolio of businesses” include, among others, a natural entrepreneur from among the family members who can embrace business opportunities. Both Stephen Rubin – the second generation of Pentland Group and Marco Drago – the third generation of De Agostini proved to be savvy investment managers by entering various industries outside of their core business. These entrepreneurial activities were initially small and did not fundamentally transform the overall portfolio until one of them led to a major liquidity event: the sale of Reebok for Pentland and the sale of the Italian Yellow Pages for De Agostini.

Driven by their entrepreneurial spirits both Stephen Rubin and Marco Drago used the liquidity to intensify the diversification of their business portfolios, progressively marginalizing the legacy businesses in the overall family portfolios. In both instances, the business decisions led to a drastic change of the family mindsets, from inheritors of a single business focus to stewards of a dynamic family portfolio, a family of brands for Pentland and portfolio of industrial and financial assets for De Agostini.

Marta Widz is a Research Fellow at the Global Family Business Center at IMD and the evaluation committee member for the IMD Global Family Business Award. She obtained her PhD at the Center for Family Business at the University of St. Gallen (CFB-HSG), Switzerland. She is a specialist in corporate governance of family firms, family governance, and entrepreneurship in family business. Marta can be reached at marta.widz@imd.org.

Benoît Leleux is the Stephan Schmidheiny Professor of Entrepreneurship and Finance at IMD since 1999 and the Director of the IMD Global Family Business Award since 2008. He was previously Visiting Professor of Entrepreneurship at INSEAD and Associate Professor and Zubillaga Chair in Finance and Entrepreneurship at Babson College, Wellesley, MA (USA) from 1994 to 1999. He is a specialist in entrepreneurship, venture capital, private equity and corporate venturing, with a strong interest in family business. Benoît can be reached at benoit.leleux@imd.org.

Marta Widz is a Research Fellow at the Global Family Business Center at IMD and the evaluation committee member for the IMD Global Family Business Award. She obtained her PhD at the Center for Family Business at the University of St. Gallen (CFB-HSG), Switzerland. She is a specialist in corporate governance of family firms, family governance, and entrepreneurship in family business. Marta can be reached at marta.widz@imd.org.

Benoît Leleux is the Stephan Schmidheiny Professor of Entrepreneurship and Finance at IMD since 1999 and the Director of the IMD Global Family Business Award since 2008. He was previously Visiting Professor of Entrepreneurship at INSEAD and Associate Professor and Zubillaga Chair in Finance and Entrepreneurship at Babson College, Wellesley, MA (USA) from 1994 to 1999. He is a specialist in entrepreneurship, venture capital, private equity and corporate venturing, with a strong interest in family business. Benoît can be reached at benoit.leleux@imd.org.

Related Article