The Need for Two Pillars of Governance

In the initial stages of a family enterprise, decision-making is simple: there is one business and few family members. With growing success, complexity inevitably creeps in. The family expands into multiple entities—a foundation, a family office, more businesses—which must be coordinated. New generations of owners press for more services or new directions for the business or the wealth.

To respond, a business family must expand its decision-making beyond a simple board populated mostly with family members. It must govern its escalating business and financial affairs and its increasingly complicated family. There are non-financial family activities to be organized, with the occasional family conflict to be mediated so neither the business nor the family are undermined. Family members who may not (yet?) be shareholders are nonetheless important and need to be heard. As recent research with Hundred Year Family Enterprises has shown1, the capabilities nested within the family side of governance most often determine the longevity of the family enterprise. Without effective governance to organize their experience and connection as an extended family, many prosperous family enterprises standing on only one shaky leg will eventually fall.

The Two Pillar Model

A business family needs governance with both an enterprise pillar and a family pillar. A straightforward description of these two pillars is easier for families to grasp than the typical complexity of models derived from corporate governance. It also emphasizes the process of collaboration that is central to the success of family enterprises, showing how each responsible entity has a voice and/or a vote in various decisions.

Business First: The Enterprise Pillar

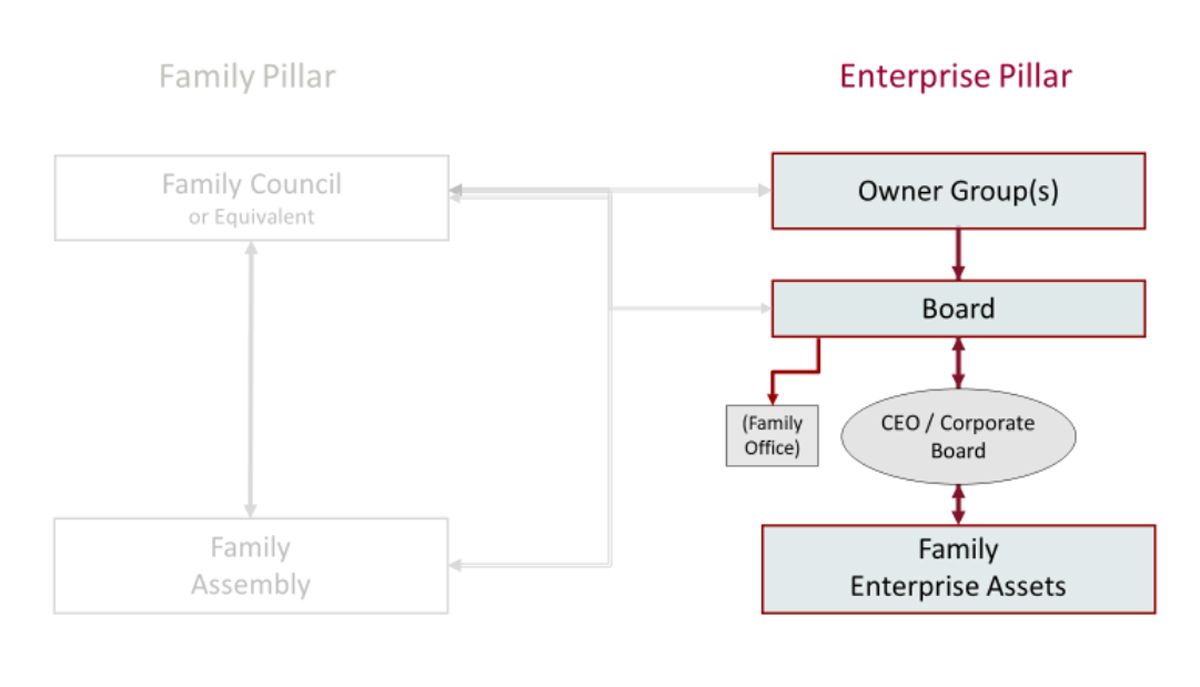

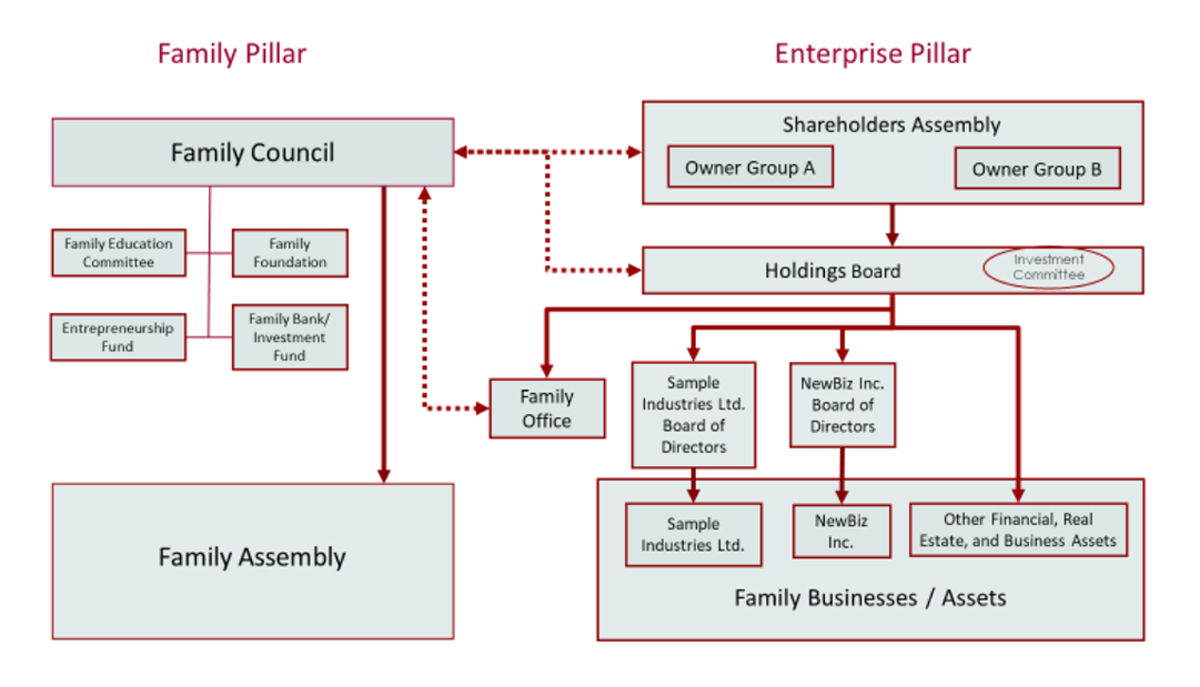

Most successful family businesses create the enterprise pillar first as they build an increasingly complex enterprise. Distilled to its most basic form, the enterprise pillar has the following elements (Figure 1):

As the family expands into multiple assets (e.g., operating businesses, real estate, investments, shared properties) owned by multiple branches or households, there is a pressing need for alignment and integration. Between the owners and their assets sit layers of enterprise governance and a myriad of financial, legal, advisory, and administrative functions and entities.

Most typically there may be one or more boards of directors with either fiduciary or advisory status, overseeing the various corporate management structures which administer the family’s individual assets. Owners present their goals and expectations to the board which is then charged with representing these to the corporate management running the business(es). Corporate management reports to the board which reports to the owners. There may be multiple boards of directors overseeing separate businesses or investments, or there may be one omnibus board charged with oversight and administration of all the family’s enterprises.

Sidebar

This week’s contributors are both presenting at the first Virtual FFI Global Conference. This three-day event brings together speakers from around the world to share latest research and perspectives on the issues facing families in business and families of wealth.

It’s never been more convenient to attend the premier event in the field of family enterprise. Register for one segment, one day or the entire conference!

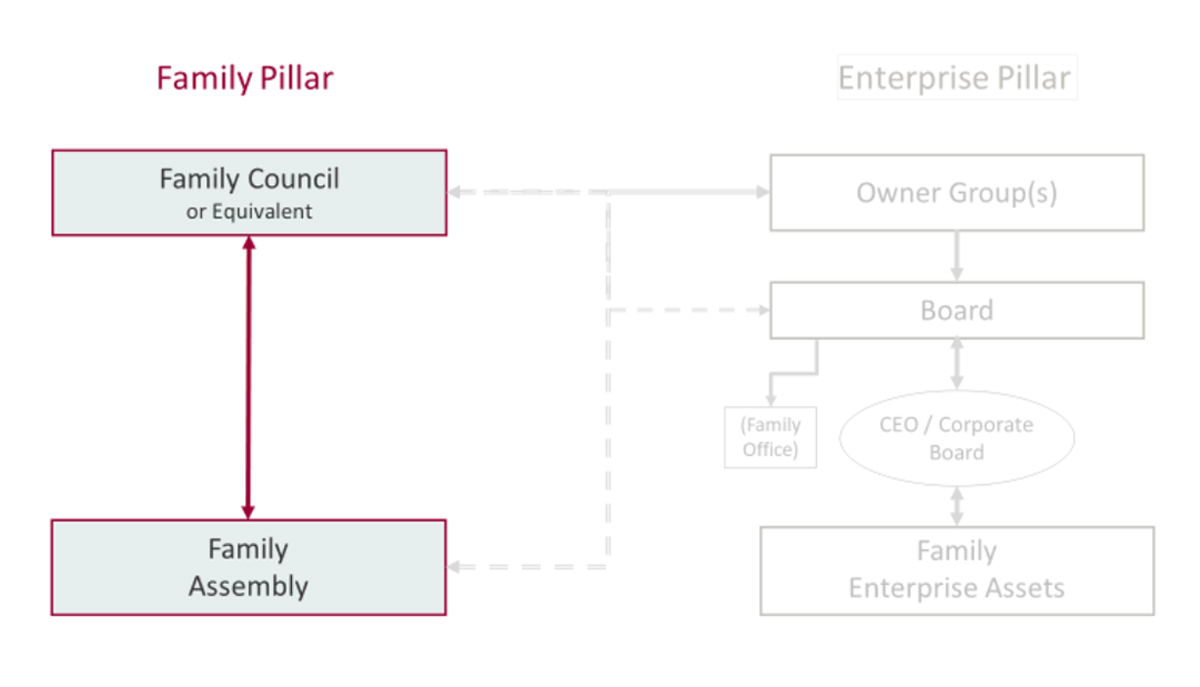

Emergence of the Family Pillar

At a certain level of financial success, a business family must turn its attention to constructing the family pillar of governance. The impetus to establish family governance may arise within the family, perhaps from proliferating branches seeking a forum in which to communicate and align their interests. Sometimes, farsighted nonfamily advisors will perceive the need to prepare for oncoming challenges or opportunities. In either case, family members will require some method of gathering, getting to know each other, celebrating their legacy, redefining their core values and culture, educating and engaging new generations, and fostering innovation and entrepreneurship. These activities are the province of the family pillar in a governance system (Figure 2).

The family pillar develops typically in one of two ways:

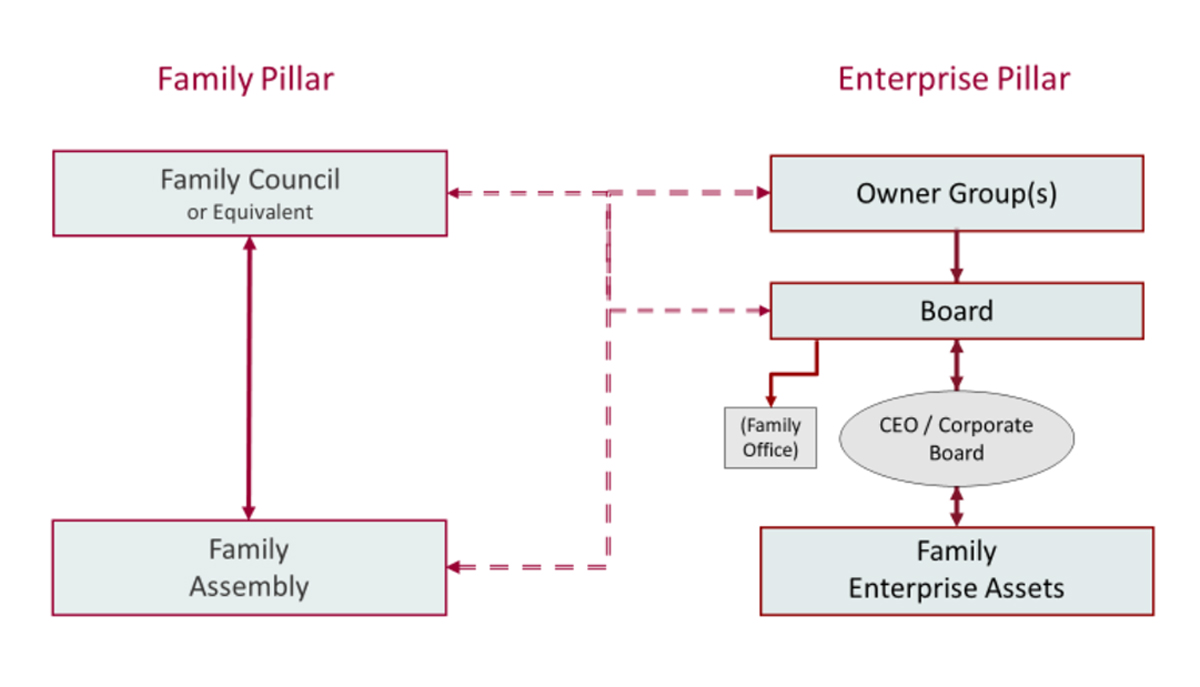

Collaboration: How the System Succeeds

Each pillar represents a unique system with different goals, constituents, and concerns. But they are highly interdependent. To work effectively, the two pillars must coordinate, collaborate, and negotiate (Figure 3). These connections are not reporting relationships, as within each of the pillars. These are channels of discussion, information-sharing, and integration of the authority vested in each governance entity.

Adding Complexity and Individuality

Every family creates a governance system that builds out these basic elements in their own way. Figure 4 displays a model drawn from a global third-generation family enterprise, showing the committees that make up their family governance and the collaboration relationships between business and family.

Two Strong Pillars Support an Enduring Family Enterprise

This fundamental model, with complexity customized to each family, eliminates the common confusion surrounding the creation of governance. Various functions or responsibilities are easily assigned to either the family pillar or enterprise pillar. Certain adaptations are required for non-Western cultures related to jurisdiction, the legal system, and the presence of collective family ownership. Yet, for the many remarkable enterprises building a great family alongside a great business, the two pillars of family enterprise governance support a legacy that endures across generations.

References

1 Dennis T. Jaffe (2020), Borrowed from Your Grandchildren: The Evolution of 100-Year Family Enterprises (Wiley)

2 Barbara Hauser (2002). Family governance: Who, what, and how. Journal of Wealth Management. DOI