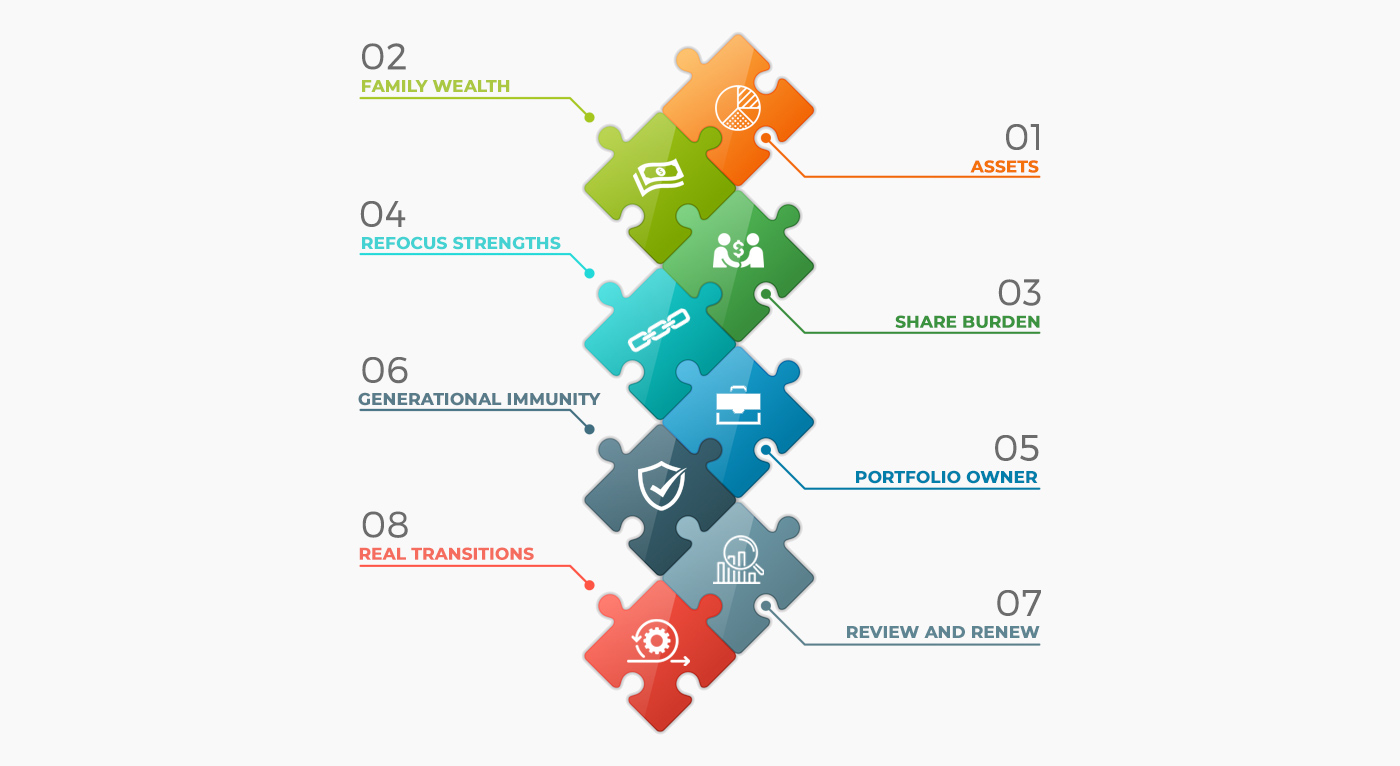

How can advisors help family enterprises navigate these unchartered waters and potentially transform themselves? I have observed eight key actions that families have taken to secure a sustainable future. Advisors can prompt the necessary discussions within their client families, help them review the hygienic factors for survival, and partner with them in the journey of long-term planning. While my observations are drawn mainly from Asian families who experienced the first wave of the pandemic, these actions should also have the potential to help families from other regions.

1. Know what assets you have

Cash is king, but this is true only if you know where your cash is. In my experience, many Asian wealth creators struggle to come up with a full list of family assets because they may not want any single person—inside or outside of the family—to know the full picture. Fragmented information poses a serious threat to holistic risk assessment and delays responses when an abrupt drop in asset prices can create a rupture in the capital chain. This principle can be extended to cover “knowing what you invest in,” that is, avoiding complex structured products.

2. Keep your family wealth in the right hands

Asian wealth creators tend to avoid separating family wealth from corporate money. The bundling of family and corporate accounts can result in cash flow issues in the operating businesses that penetrate the life of the owning family. Another issue is the possible actions of “nominees”1 who hold shares on a family’s behalf—still a common practice in China and a few other Asian countries. Actions of these “nominees” are often less scrutinized and sometimes their selling shares in a volatile market can threaten firm survival.

3. Share your burden2

Uncertainty breeds anxiety. COVID-19 and other ongoing disruptions spread tension through the family, business, and ownership systems. Family leaders may direct their frustration and anger at other stakeholders, externalizing the blame and destroying their hard-earned trust and legitimacy. As family advisor Jay Hughes has said, it is time to pause and be still3, especially when the family owners become aware that anxiety has taken over their rational decision-making. Rather than shouldering all of the responsibilities on their own, family leaders should take the opportunity to engage with other stakeholders and develop a shared response. Anxiety in the system can be reduced when stakeholders see a clearer picture and the role they play within it. It is also an important time to be intentional about regularly checking-in with the wider family and to give each other space to process their own anxiety.

Sidebar

by Chung, Jeremy Cheng, and Chin Chin Koh

4. Refocus on your family’s natural strengths

Enterprising families have a unique survival instinct, which is strongly backed by family unity and shared values. In the current crisis, several family businesses I know have invested more in technologies to strengthen their online presence and digital operations and to diversify, even though they are facing a downside risk. They see that such investment can pave the way for post-crisis growth. Once they invest, families hold a long-term view and exercise the power of patient capital. Refocusing on these natural advantages of the enterprising family can help such families see the positive side of repeated disruptions given their long-term outlook. It is also a time when shared family values should guide actions.

5. Act like a portfolio owner4

- Balance the past glory and the current concern: Founders attach great emotional value to the legacy business, the success of which often defines their personal identity. However, this emotional attachment may drive biased reinvestment decisions, diverting resources to the legacy business as an ongoing concern in the face of a wave of disruptions. Instead, family leaders should manage all the resources as part of the family portfolio and exercise emotional calm when evaluating the underlying assets. They should focus on the value of the entire portfolio, and not just the legacy business per se.

- Diversify and restructure: To go from strength to strength, families may have to step out of their own comfort zone, diversify, and perhaps restructure their portfolio. This requires the family to build its capacity to judge investment opportunities from a strategic perspective and to break its control mentality and consider teaming up with other capital sources.5 Several family groups in Hong Kong are trying to privatize their listed arms, taking advantage of the extremely low price-to-book ratio. Owning families may have to steady themselves to go through some emotional dissonance when making hard decisions like these but keeping a focus on a shared future can help to reduce the pain.

6. Develop generational immunity in the family governance system

Authoritarian leaders can make quick and forceful decisions in response to abrupt market changes, just like a general in wartime. But what if such a leader leaves the scene, especially when the enterprise has transitioned to a sibling partnership or to a group of highly diverse cousins? Families need to develop an enduring model in order to learn together and to make collective and quick decisions. Governance structures, such as a family council or a junior board, may offer such a platform. The rising generation can be engaged to develop its agile and resilient leadership through experiential learning and through shadowing the senior members in this critical time. This can help to transform the family from one reliant on personal resilience to one where there is system resilience across the generations.

7. Review and renew

For families with an existing governance system, the current crisis affords the opportunity to review underlying structures. It is like a stress test, revealing potential cracks in the system that cannot be seen in the good times. Consider this salient example: does the family have a crisis-management protocol and regular risk assessments in place? More importantly, I encourage families to examine ways to institutionalize any new practices they develop in this crisis and to preserve them as part of the family’s collective memory. Families can incorporate these new practices into their governance system, as a module in the family education curriculum or as a practice drill, so that when the next crisis arises, the family can react faster and more effectively as part of their “immune response.”

8. Watch for real transitions, not simply resilience

While resilience has become a buzzword these days, this quality alone cannot secure a successful future for families as we see the pandemic as a disruption-in-disruptions. A resilient family may recover quickly from an unpleasant event and go back to the “good old days.” But things are never going to be the same in this new normal. I choose to see the pandemic as a portal to a new world6 or as a rite of passage7 that we all have to go through. This means that enterprising families need to embrace:

- Real transitions;

- Regenerating their visions of why they stay together as a family;

- The meanings of agility and entrepreneurship; and

- Methodologies for engaging the rising generation.

These eight actions are by no means exhaustive. Obviously, staying connected as a family and managing feelings of loss are other important actions to take. However, the fundamental action is to survive and thrive, and the foundation for this involves investing in the family’s human and social capital. We advisors have a good role to play in helping families develop new mindsets, skills, and capabilities in this era of disruption-in-disruptions.

Stay well and stay healthy!

The author would like to thank Christian Stewart for sharing resources and thoughts related to the development of this article, and Marshall Jen, Esther Kong, and Blanche Li for their kind comments on an earlier draft. All errors rest with the author.

Resources

1 “Nominee shareholding is an arrangement where one person makes a capital contribution and holds the shares on behalf of the actual owner to circumvent restrictions on who can own shares or to accomplish other business objectives.” Source: China Business Law Journal

3Personal communication between Jay Hughes and Christian Stewart

4The concept is grounded in Professor John Davis’ work on “owner’s mindset” and more broadly in the portfolio entrepreneurship literature.

6https://www.ft.com/content/10d8f5e8-74eb-11ea-95fe-fcd274e920ca?desktop=true